FARTCOINUSDT – Probability Analysis for October 25, 2025

FARTCOINUSDT — Probability Analysis (October 25, 2025)

Market snapshot

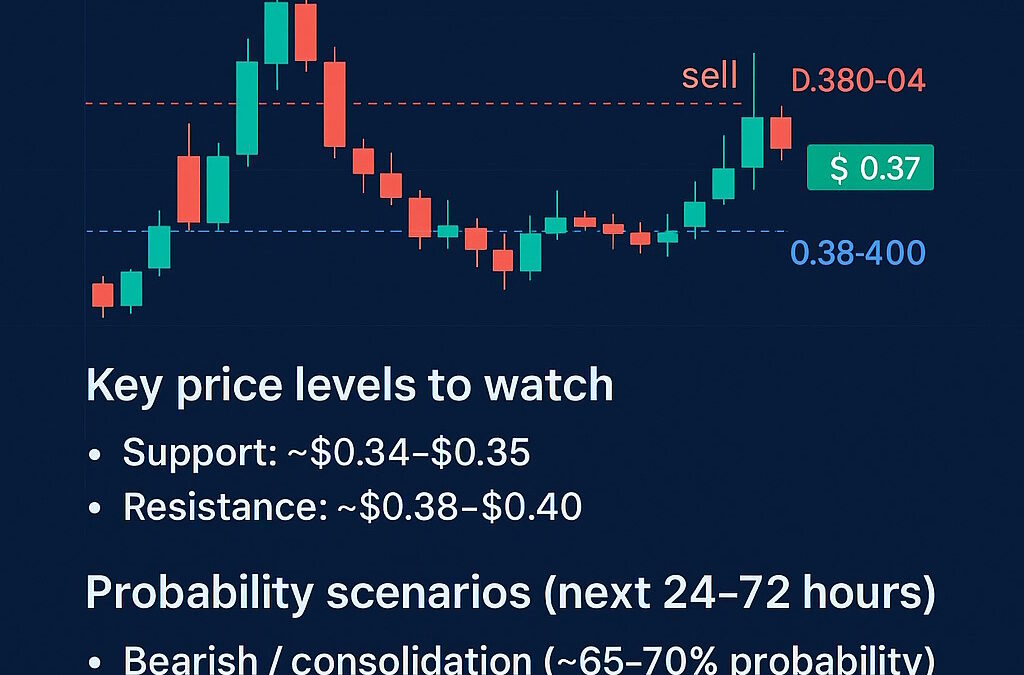

As of October 25, 2025, FARTCOIN/USDT is trading around $0.37 USD according to the latest reported data. (CoinMarketCap) The market cap remains in the ~$370-400 million range, and trading volume continues to stay elevated, indicating that liquidity is solid but volatility remains significant.

Short-term summary of today’s setup

The pair has edged slightly higher after recent consolidation, suggesting a mild recovery attempt. However, the underlying structure is still corrective: the price is hovering around recent support zones and lacking a strong breakout. The caution flag remains raised until directional volume and trend confirmation show up.

Key price levels to watch

Support levels:

- ~$0.34-$0.35 — this zone has held recent dips and serves as the first line of defense.

- ~$0.30 — deeper support level, which could be tested if corrective momentum accelerates downward.

Resistance levels:

- ~$0.38-$0.40 — the near-term barrier where recent upward efforts stalled.

- ~$0.45 — a more ambitious breakout zone, but this requires stronger momentum and volume.

Technical read (what indicators are saying)

On intraday frames (5-60 min), price action shows small higher lows, hinting at short-term accumulation. Yet, on the 4-hour and daily frames, moving averages remain above the current price or are flattening — which indicates bullish structure is not yet reclaimed. Momentum indicators such as RSI and MACD are neutral to slightly bullish but lacking strong divergence or crossover signals.

Probability Scenarios (next 24-72 hours)

Bearish / consolidation scenario (~65-70% probability)

If FARTCOIN / USDT closes below the ~$0.34-$0.35 support band with rising volume, expect a retest toward ~$0.30 and possibly sideways action until clear buyer dominance returns.

Bullish scenario (~30-35% probability)

If price holds above ~$0.35 and then breaks above ~$0.38 with increasing volume, a move toward ~$0.40-$0.45 becomes plausible. The trigger would be a clean breakout and subsequent retest of the breakout level.

Risk factors & watch-points

- Meme-coin dynamics: FARTCOIN’s price remains highly sensitive to sentiment, social media, and large holder activity.

- Large holder/whale concentration: If large wallets decide to distribute, the impact could be outsized.

- Broader crypto market tone: If risk-on sentiment dries up or large caps weaken, speculative coins like FARTCOIN are often harder hit.

Trade management checklist (if you trade)

- Entry: Prefer to wait for confirmation of a hold above ~$0.35 or a breakout above ~$0.38 with volume.

- Stop-loss: For long positions, place a stop below ~$0.30 to manage downside risk.

- Targets: Partial profit at ~$0.40; further target ~$0.45 if breakout structure strengthens.

- Position sizing: Given high volatility, keep exposure modest and risk per trade low.

Conclusion

For October 25, 2025, FARTCOIN/USDT remains in a vulnerable position. The more likely scenario is consolidation or mild downside (~65-70% probability) unless the ~$0.35 support holds and momentum returns. A bullish outcome (~30-35% probability) becomes viable if price breaks firmly above ~$0.38 with volume backing. Traders should carefully monitor key support and resistance levels, volume dynamics, and broader market sentiment.

Disclaimer:

The content on this website is for educational purposes only and not to be taken as financial advice. Please do your own research.